The cannabis industry is expanding drastically – particularly in the US – where more states are opting for the legalisation and decriminalisation of cannabis products. In 2019, Wall Street’s cannabis analyst predicted the cannabis market to be worth $80 billion by 2030. Today, recreational cannabis or, as some states refer to it, “adult-use cannabis” is legal in 18 states along with Washington D.C., and medical marijuana is legal in 37 states.

However, cannabis regulations and taxes are determined at the state and local levels, where laws change dramatically across state lines. It is important for cannabis business owners and anyone who is considering taking part in the cannabis industry to be familiar with the tax laws and regulations and be prepared to adapt to them.

Figure 1. Recreational cannabis tax rates by states that have or are legalizing recreational cannabis. Most states levy an excise tax in addition to state and local sales taxes. Note some states’ sales tax rates vary from city to city and are not shown.

For anyone who is in the industry, looking to start a cannabis business, or wanting to know more about the industry, it is helpful to understand some of the tax differences between states. Since no two states have the same cannabis industry regulations, it is advisable to understand the rules and regulations imposed in your state first. Marijuana tax and tax rates vary from one state to another, and there are several taxes to be aware of. Percentage-of-sale, weight-based tax, and potency-based tax are the three of the main ways recreational cannabis is taxed.

1. Sale-based, or percentage-of-sale, taxes are similar to the sales tax we are familiar with, where the consumer pays a certain percentage on the total purchase price, which is then remitted to the state. Unlike other excise taxes, this tax rate is typically higher than the state’s general sales tax rate.

Figure 2. The retail sale of recreational cannabis for Montana, New Jersey, New York, South Dakota, and Vermont have not begun yet. Rates are subject to change depending on state laws and legislation.

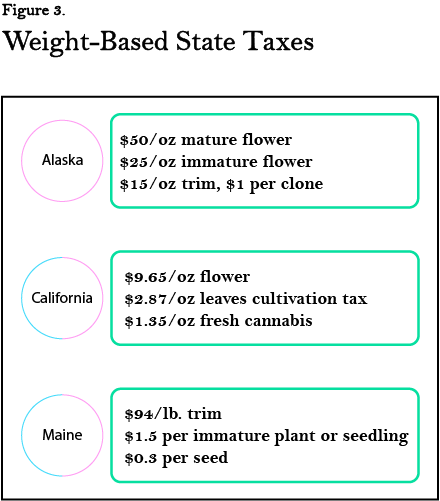

2. Weight-based taxes are based on the weight of the cannabis product. Usually, the rates are determined by the marijuana product type. For example, in California, cultivators pay a cultivation tax of $9.25 per ounce for flowers. However, in Alaska, cultivators pay $50 per ounce for flowers. This cultivation tax is assumed to be accounted for in the final consumer purchase cost.

Figure 3. Alaska implements taxes based on weight without being subjected to statewide taxes, but local and municipality taxes are levied. California and Maine levy weight-based taxes in addition to sale-based taxes.

3. Potency-based taxes are based on the THC content level of the cannabis product. For example, in Illinois, cannabis products with 35% or less THC are taxed at 10%, while products with more than 35% THC content are taxed at 25%. New York’s legislation for recreational cannabis cites the implementation of potency-based tax based upon the milligram of THC depending on the cannabis product.

Figure 4. Illinois implements potency-based taxes on cannabis product’s THC content. New York’s legislation for recreational cannabis will levy taxes based on the milligrams of THC instead of the product’s overall THC content per cent level.

Some states will use more than one of these taxes along with their general sales and local taxes on recreational products. On the other hand, some states exempt taxes for patients with state-approved medical marijuana cards. For example, in California, medical marijuana is exempt from state tax but still incurs the 15% excise tax. But in Washington, medical marijuana is not taxed.

This means that cannabis businesses need to constantly keep up with regulations and rules, even more so, if operating in multiple states. Luckily there are software licenses that comply with specific state regulations and tax rates already. To easily stay on top and handle cannabis laws and industry trends to grow your cannabis business in the US, you can get in touch with a CannaSky expert today or schedule a free demo to get started.